New tariffs on food imports from the UK and Europe into the US in 2025 are creating pricing challenges for brands that rely on the US market for volume and growth.

A major European biscuit business whose production in Europe ensures both quality and provenance no matter where in the world the products are enjoyed.

At first, brands absorbed the impact of the new tariffs in the hope that US government policy might change. Once it became clear the tariffs were here to stay, prices needed to adjust to reflect this new reality. The key question now is how much of the tariff cost can be passed on to shoppers, and how much must be absorbed as part of the cost of doing business in the US.

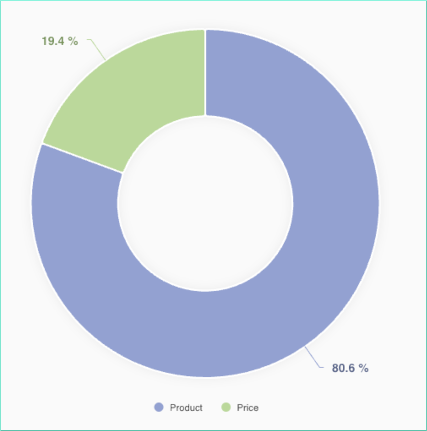

EPIC was selected to identify the optimal price point in a category where tariffs affect only part of the market, as around 60% of total volume still comes from US-made premium cookie brands that are not impacted by the tariffs.

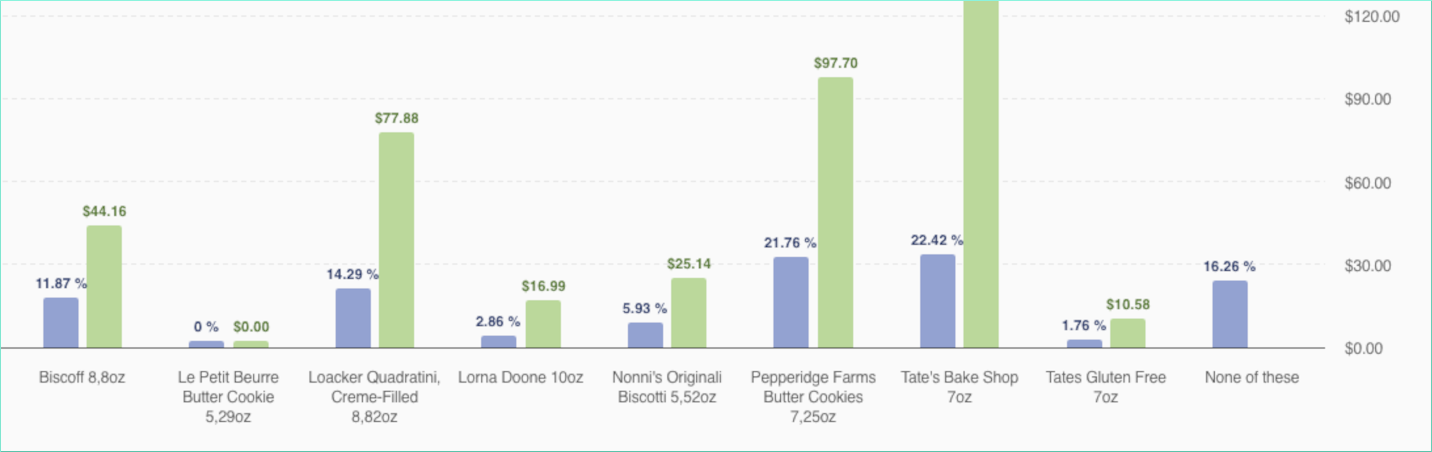

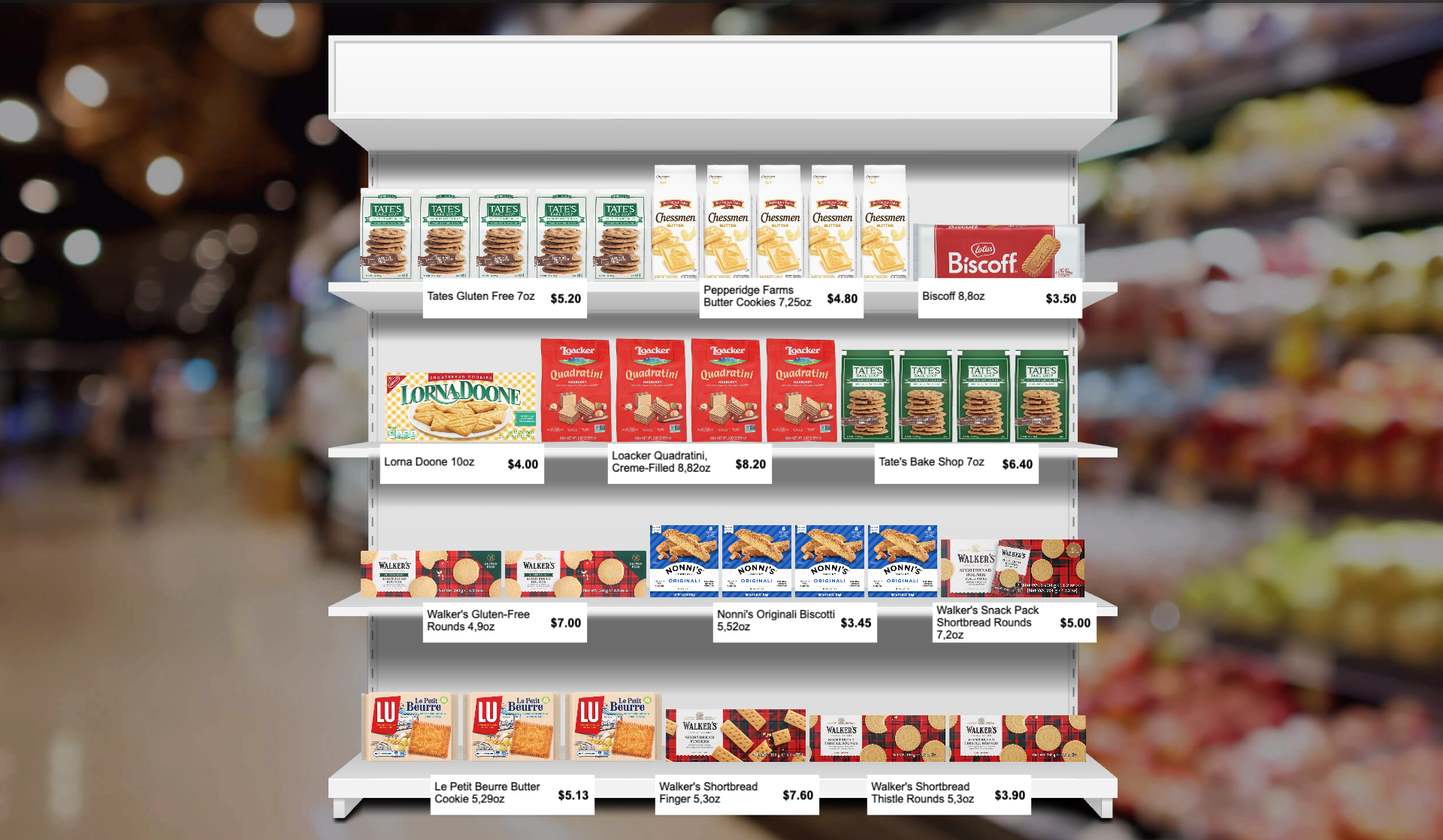

We ran a shelf conjoint to test 12 leading products in the specialty biscuit aisle, which is where international players such as Lu, Lotus, Loacker, Walker’s and Nonni’s are stocked. The test was completed on a grocery store fixture mock-up and secured an audience of 455 shoppers that regularly buy from this category.

We found that, on one hand, US brands command a lower elasticity due to the deep heritage of brands like Lorna Doone, Pepperidge Farm and Tate’s Bake Shop, on the other hand they stand to benefit significantly from these forced increases if all the tariff cost is passed onto the consumers. We calculate the US brands would steal between 3-5.7% of total market share from EU brands due to the price hikes.